Goal:

- Setup inputs for batch-RL model

- Implement Fitted Q-Iteration

import numpy as np

import pandas as pd

from scipy.stats import norm

import random

import sys

sys.path.append("..")

import grading

import time

import matplotlib.pyplot as plt

### ONLY FOR GRADING. DO NOT EDIT ###

submissions=dict()

assignment_key="0jn7tioiEeiBAA49aGvLAg"

all_parts=["wrZFS","yqg6m","KY5p8","BsRWi","pWxky"]

### ONLY FOR GRADING. DO NOT EDIT ###

COURSERA_TOKEN = 'jLCcoh3BbMO5hsCc' # the key provided to the Student under his/her email on submission page

COURSERA_EMAIL = 'bai_liping@outlook.com'# the email

Parameters for MC simulation of stock prices

S0 = 100 # initial stock price

mu = 0.05 # drift

sigma = 0.15 # volatility

r = 0.03 # risk-free rate

M = 1 # maturity

T = 6 # number of time steps

N_MC = 10000 # 10000 # 50000 # number of paths

delta_t = M / T # time interval

gamma = np.exp(- r * delta_t) # discount factor

Black-Sholes Simulation

Simulate \(N_{MC}\) stock price sample paths with \(T\) steps by the classical Black-Sholes formula.

\[dS_t=\mu S_tdt+\sigma S_tdW_t\quad\quad S_{t+1}=S_te^{\left(\mu-\frac{1}{2}\sigma^2\right)\Delta t+\sigma\sqrt{\Delta t}Z}\]where \(Z\) is a standard normal random variable.

Based on simulated stock price \(S_t\) paths, compute state variable \(X_t\) by the following relation.

\[X_t=-\left(\mu-\frac{1}{2}\sigma^2\right)t\Delta t+\log S_t\]Also compute

\[\Delta S_t=S_{t+1}-e^{r\Delta t}S_t\quad\quad \Delta\hat{S}_t=\Delta S_t-\Delta\bar{S}_t\quad\quad t=0,...,T-1\]where \(\Delta\bar{S}_t\) is the sample mean of all values of \(\Delta S_t\).

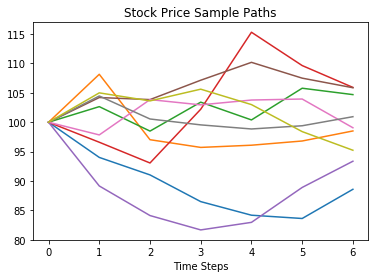

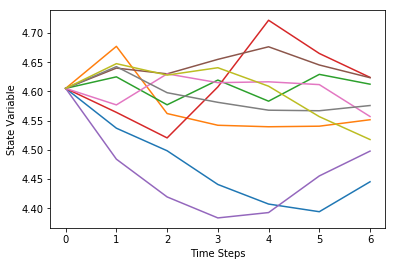

Plots of 5 stock price \(S_t\) and state variable \(X_t\) paths are shown below.

# make a dataset

starttime = time.time()

np.random.seed(42) # Fix random seed

# stock price

S = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

S.loc[:,0] = S0

# standard normal random numbers

RN = pd.DataFrame(np.random.randn(N_MC,T), index=range(1, N_MC+1), columns=range(1, T+1))

for t in range(1, T+1):

S.loc[:,t] = S.loc[:,t-1] * np.exp((mu - 1/2 * sigma**2) * delta_t + sigma * np.sqrt(delta_t) * RN.loc[:,t])

delta_S = S.loc[:,1:T].values - np.exp(r * delta_t) * S.loc[:,0:T-1]

delta_S_hat = delta_S.apply(lambda x: x - np.mean(x), axis=0)

# state variable

X = - (mu - 1/2 * sigma**2) * np.arange(T+1) * delta_t + np.log(S) # delta_t here is due to their conventions

endtime = time.time()

print('\nTime Cost:', endtime - starttime, 'seconds')

# plot 10 paths

step_size = N_MC // 10

idx_plot = np.arange(step_size, N_MC, step_size)

plt.plot(S.T.iloc[:, idx_plot])

plt.xlabel('Time Steps')

plt.title('Stock Price Sample Paths')

plt.show()

plt.plot(X.T.iloc[:, idx_plot])

plt.xlabel('Time Steps')

plt.ylabel('State Variable')

plt.show()

Time Cost: 0.0767676830291748 second

Define function terminal_payoff to compute the terminal payoff of a European put option.

\[H_T\left(S_T\right)=\max\left(K-S_T,0\right)\]def terminal_payoff(ST, K):

# ST final stock price

# K strike

payoff = max(K-ST, 0)

return payoff

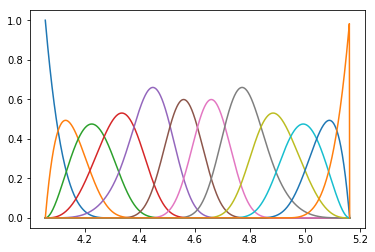

Define spline basis functions

import bspline

import bspline.splinelab as splinelab

X_min = np.min(np.min(X))

X_max = np.max(np.max(X))

print('X.shape = ', X.shape)

print('X_min, X_max = ', X_min, X_max)

p = 4 # order of spline (as-is; 3 = cubic, 4: B-spline?)

ncolloc = 12

tau = np.linspace(X_min,X_max,ncolloc) # These are the sites to which we would like to interpolate

# k is a knot vector that adds endpoints repeats as appropriate for a spline of order p

# To get meaninful results, one should have ncolloc >= p+1

k = splinelab.aptknt(tau, p)

# Spline basis of order p on knots k

basis = bspline.Bspline(k, p)

f = plt.figure()

# B = bspline.Bspline(k, p) # Spline basis functions

print('Number of points k = ', len(k))

basis.plot()

plt.savefig('Basis_functions.png', dpi=600)

X.shape = (10000, 7)

X_min, X_max = 4.05752797076 5.16206652917

Number of points k = 17

type(basis)

bspline.bspline.Bspline

X.values.shape

(10000, 7)

Make data matrices with feature values

“Features” here are the values of basis functions at data points The outputs are 3D arrays of dimensions num_tSteps x num_MC x num_basis

num_t_steps = T + 1

num_basis = ncolloc # len(k) #

data_mat_t = np.zeros((num_t_steps, N_MC,num_basis ))

print('num_basis = ', num_basis)

print('dim data_mat_t = ', data_mat_t.shape)

# fill it, expand function in finite dimensional space

# in neural network the basis is the neural network itself

t_0 = time.time()

for i in np.arange(num_t_steps):

x = X.values[:,i]

data_mat_t[i,:,:] = np.array([ basis(el) for el in x ])

t_end = time.time()

print('Computational time:', t_end - t_0, 'seconds')

num_basis = 12

dim data_mat_t = (7, 10000, 12)

Computational time: 13.818428993225098 seconds

# save these data matrices for future re-use

np.save('data_mat_m=r_A_%d' % N_MC, data_mat_t)

print(data_mat_t.shape) # shape num_steps x N_MC x num_basis

print(len(k))

(7, 10000, 12)

17

Dynamic Programming solution for QLBS

The MDP problem in this case is to solve the following Bellman optimality equation for the action-value function.

\[Q_t^\star\left(x,a\right)=\mathbb{E}_t\left[R_t\left(X_t,a_t,X_{t+1}\right)+\gamma\max_{a_{t+1}\in\mathcal{A}}Q_{t+1}^\star\left(X_{t+1},a_{t+1}\right)\space|\space X_t=x,a_t=a\right],\space\space t=0,...,T-1,\quad\gamma=e^{-r\Delta t}\]where \(R_t\left(X_t,a_t,X_{t+1}\right)\) is the one-step time-dependent random reward and \(a_t\left(X_t\right)\) is the action (hedge).

Detailed steps of solving this equation by Dynamic Programming are illustrated below.

With this set of basis functions \(\left\{\Phi_n\left(X_t^k\right)\right\}_{n=1}^N\), expand the optimal action (hedge) \(a_t^\star\left(X_t\right)\) and optimal Q-function \(Q_t^\star\left(X_t,a_t^\star\right)\) in basis functions with time-dependent coefficients. \(a_t^\star\left(X_t\right)=\sum_n^N{\phi_{nt}\Phi_n\left(X_t\right)}\quad\quad Q_t^\star\left(X_t,a_t^\star\right)=\sum_n^N{\omega_{nt}\Phi_n\left(X_t\right)}\)

Coefficients \(\phi_{nt}\) and \(\omega_{nt}\) are computed recursively backward in time for \(t=T−1,...,0\).

Coefficients for expansions of the optimal action \(a_t^\star\left(X_t\right)\) are solved by

\[\phi_t=\mathbf A_t^{-1}\mathbf B_t\]where \(\mathbf A_t\) and \(\mathbf B_t\) are matrix and vector respectively with elements given by

\[A_{nm}^{\left(t\right)}=\sum_{k=1}^{N_{MC}}{\Phi_n\left(X_t^k\right)\Phi_m\left(X_t^k\right)\left(\Delta\hat{S}_t^k\right)^2}\quad\quad B_n^{\left(t\right)}=\sum_{k=1}^{N_{MC}}{\Phi_n\left(X_t^k\right)\left[\hat\Pi_{t+1}^k\Delta\hat{S}_t^k+\frac{1}{2\gamma\lambda}\Delta S_t^k\right]}\]Define function function_A and function_B to compute the value of matrix \(\mathbf A_t\) and vector \(\mathbf B_t\).

Define the option strike and risk aversion parameter

risk_lambda = 0.001 # 0.001 # 0.0001 # risk aversion

K = 100 #

# Note that we set coef=0 below in function function_B_vec. This correspond to a pure risk-based hedging

Part 1: Implement functions to compute optimal hedges

Instructions: Copy-paste implementations from the previous assignment, i.e. QLBS as these are the same functions

# functions to compute optimal hedges

def function_A_vec(t, delta_S_hat, data_mat, reg_param):

"""

function_A_vec - compute the matrix A_{nm} from Eq. (52) (with a regularization!)

Eq. (52) in QLBS Q-Learner in the Black-Scholes-Merton article

Arguments:

t - time index, a scalar, an index into time axis of data_mat

delta_S_hat - pandas.DataFrame of dimension N_MC x T

data_mat - pandas.DataFrame of dimension T x N_MC x num_basis

reg_param - a scalar, regularization parameter

Return:

- np.array, i.e. matrix A_{nm} of dimension num_basis x num_basis

"""

### START CODE HERE ### (≈ 5-6 lines of code)

# A_mat = your code goes here ...

X_mat = data_mat[t, :, :]

num_basis_funcs = X_mat.shape[1]

this_dS = delta_S_hat.loc[:, t]

hat_dS2 = (this_dS ** 2).reshape(-1, 1)

A_mat = np.dot(X_mat.T, X_mat * hat_dS2) + reg_param * np.eye(num_basis_funcs)

### END CODE HERE ###

return A_mat

def function_B_vec(t,

Pi_hat,

delta_S_hat=delta_S_hat,

S=S,

data_mat=data_mat_t,

gamma=gamma,

risk_lambda=risk_lambda):

"""

function_B_vec - compute vector B_{n} from Eq. (52) QLBS Q-Learner in the Black-Scholes-Merton article

Arguments:

t - time index, a scalar, an index into time axis of delta_S_hat

Pi_hat - pandas.DataFrame of dimension N_MC x T of portfolio values

delta_S_hat - pandas.DataFrame of dimension N_MC x T

S - pandas.DataFrame of simulated stock prices

data_mat - pandas.DataFrame of dimension T x N_MC x num_basis

gamma - one time-step discount factor $exp(-r \delta t)$

risk_lambda - risk aversion coefficient, a small positive number

Return:

B_vec - np.array() of dimension num_basis x 1

"""

# coef = 1.0/(2 * gamma * risk_lambda)

# override it by zero to have pure risk hedge

coef = 0. # keep it

### START CODE HERE ### (≈ 3-4 lines of code)

# B_vec = your code goes here ...

tmp = Pi_hat.loc[:,t+1] * delta_S_hat.loc[:, t]

X_mat = data_mat[t, :, :] # matrix of dimension N_MC x num_basis

B_vec = np.dot(X_mat.T, tmp)

### END CODE HERE ###

return B_vec

Compute optimal hedge and portfolio value

Call function_A and function_B for \(t=T-1,...,0\) together with basis function \(\Phi_n\left(X_t\right)\) to compute optimal action \(a_t^\star\left(X_t\right)=\sum_n^N{\phi_{nt}\Phi_n\left(X_t\right)}\) backward recursively with terminal condition \(a_T^\star\left(X_T\right)=0\).

Once the optimal hedge \(a_t^\star\left(X_t\right)\) is computed, the portfolio value \(\Pi_t\) could also be computed backward recursively by

\[\Pi_t=\gamma\left[\Pi_{t+1}-a_t^\star\Delta S_t\right]\quad t=T-1,...,0\]together with the terminal condition \(\Pi_T=H_T\left(S_T\right)=\max\left(K-S_T,0\right)\) for a European put option.

Also compute \(\hat{\Pi}_t=\Pi_t-\bar{\Pi}_t\), where \(\bar{\Pi}_t\) is the sample mean of all values of \(\Pi_t\).

starttime = time.time()

# portfolio value

Pi = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Pi.iloc[:,-1] = S.iloc[:,-1].apply(lambda x: terminal_payoff(x, K))

Pi_hat = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Pi_hat.iloc[:,-1] = Pi.iloc[:,-1] - np.mean(Pi.iloc[:,-1])

# optimal hedge

a = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

a.iloc[:,-1] = 0

reg_param = 1e-3

for t in range(T-1, -1, -1):

A_mat = function_A_vec(t, delta_S_hat, data_mat_t, reg_param)

B_vec = function_B_vec(t, Pi_hat, delta_S_hat, S, data_mat_t)

# print ('t = A_mat.shape = B_vec.shape = ', t, A_mat.shape, B_vec.shape)

phi = np.dot(np.linalg.inv(A_mat), B_vec)

a.loc[:,t] = np.dot(data_mat_t[t,:,:],phi)

Pi.loc[:,t] = gamma * (Pi.loc[:,t+1] - a.loc[:,t] * delta_S.loc[:,t])

Pi_hat.loc[:,t] = Pi.loc[:,t] - np.mean(Pi.loc[:,t])

a = a.astype('float')

Pi = Pi.astype('float')

Pi_hat = Pi_hat.astype('float')

endtime = time.time()

print('Computational time:', endtime - starttime, 'seconds')

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:21: FutureWarning: reshape is deprecated and will raise in a subsequent release. Please use .values.reshape(...) instead

Computational time: 3.004925489425659 seconds

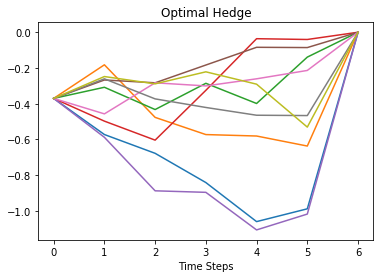

Plots of 5 optimal hedge \(a_t^\star\) and portfolio value \(\Pi_t\) paths are shown below.

# plot 10 paths

plt.plot(a.T.iloc[:,idx_plot])

plt.xlabel('Time Steps')

plt.title('Optimal Hedge')

plt.show()

plt.plot(Pi.T.iloc[:,idx_plot])

plt.xlabel('Time Steps')

plt.title('Portfolio Value')

plt.show()

Once the optimal hedge \(a_t^\star\) and portfolio value \(\Pi_t\) are all computed, the reward function \(R_t\left(X_t,a_t,X_{t+1}\right)\) could then be computed by

\[R_t\left(X_t,a_t,X_{t+1}\right)=\gamma a_t\Delta S_t-\lambda Var\left[\Pi_t\space|\space\mathcal F_t\right]\quad t=0,...,T-1\]with terminal condition \(R_T=-\lambda Var\left[\Pi_T\right]\).

Plot of 5 reward function \(R_t\) paths is shown below.

Part 2: Compute the optimal Q-function with the DP approach

Coefficients for expansions of the optimal Q-function \(Q_t^\star\left(X_t,a_t^\star\right)\) are solved by

\[$\omega_t=\mathbf C_t^{-1}\mathbf D_t\]where \(\mathbf C_t\) and \(\mathbf D_t\) are matrix and vector respectively with elements given by

\[C_{nm}^{\left(t\right)}=\sum_{k=1}^{N_{MC}}{\Phi_n\left(X_t^k\right)\Phi_m\left(X_t^k\right)}\quad\quad D_n^{\left(t\right)}=\sum_{k=1}^{N_{MC}}{\Phi_n\left(X_t^k\right)\left(R_t\left(X_t,a_t^\star,X_{t+1}\right)+\gamma\max_{a_{t+1}\in\mathcal{A}}Q_{t+1}^\star\left(X_{t+1},a_{t+1}\right)\right)}\]Define function function_C and function_D to compute the value of matrix \(\mathbf C_t\) and vector \(\mathbf D_t\).

Instructions: Copy-paste implementations from the previous assignment,i.e. QLBS as these are the same functions

def function_C_vec(t, data_mat, reg_param):

"""

function_C_vec - calculate C_{nm} matrix from Eq. (56) (with a regularization!)

Eq. (56) in QLBS Q-Learner in the Black-Scholes-Merton article

Arguments:

t - time index, a scalar, an index into time axis of data_mat

data_mat - pandas.DataFrame of values of basis functions of dimension T x N_MC x num_basis

reg_param - regularization parameter, a scalar

Return:

C_mat - np.array of dimension num_basis x num_basis

"""

### START CODE HERE ### (≈ 5-6 lines of code)

# C_mat = your code goes here ....

X_mat = data_mat[t, :, :]

num_basis_funcs = X_mat.shape[1]

C_mat = np.dot(X_mat.T, X_mat) + reg_param * np.eye(num_basis_funcs)

### END CODE HERE ###

return C_mat

def function_D_vec(t, Q, R, data_mat, gamma=gamma):

"""

function_D_vec - calculate D_{nm} vector from Eq. (56) (with a regularization!)

Eq. (56) in QLBS Q-Learner in the Black-Scholes-Merton article

Arguments:

t - time index, a scalar, an index into time axis of data_mat

Q - pandas.DataFrame of Q-function values of dimension N_MC x T

R - pandas.DataFrame of rewards of dimension N_MC x T

data_mat - pandas.DataFrame of values of basis functions of dimension T x N_MC x num_basis

gamma - one time-step discount factor $exp(-r \delta t)$

Return:

D_vec - np.array of dimension num_basis x 1

"""

### START CODE HERE ### (≈ 2-3 lines of code)

# D_vec = your code goes here ...

X_mat = data_mat[t, :, :]

D_vec = np.dot(X_mat.T, R.loc[:,t] + gamma * Q.loc[:, t+1])

### END CODE HERE ###

return D_vec

Call function_C and function_D for $t=T-1,…,0$ together with basis function $\Phi_n\left(X_t\right)$ to compute optimal action Q-function $Q_t^\star\left(X_t,a_t^\star\right)=\sum_n^N{\omega_{nt}\Phi_n\left(X_t\right)}$ backward recursively with terminal condition $Q_T^\star\left(X_T,a_T=0\right)=-\Pi_T\left(X_T\right)-\lambda Var\left[\Pi_T\left(X_T\right)\right]$.

Compare the QLBS price to European put price given by Black-Sholes formula.

\[C_t^{\left(BS\right)}=Ke^{-r\left(T-t\right)}\mathcal N\left(-d_2\right)-S_t\mathcal N\left(-d_1\right)\]# The Black-Scholes prices

def bs_put(t, S0=S0, K=K, r=r, sigma=sigma, T=M):

d1 = (np.log(S0/K) + (r + 1/2 * sigma**2) * (T-t)) / sigma / np.sqrt(T-t)

d2 = (np.log(S0/K) + (r - 1/2 * sigma**2) * (T-t)) / sigma / np.sqrt(T-t)

price = K * np.exp(-r * (T-t)) * norm.cdf(-d2) - S0 * norm.cdf(-d1)

return price

def bs_call(t, S0=S0, K=K, r=r, sigma=sigma, T=M):

d1 = (np.log(S0/K) + (r + 1/2 * sigma**2) * (T-t)) / sigma / np.sqrt(T-t)

d2 = (np.log(S0/K) + (r - 1/2 * sigma**2) * (T-t)) / sigma / np.sqrt(T-t)

price = S0 * norm.cdf(d1) - K * np.exp(-r * (T-t)) * norm.cdf(d2)

return price

Hedging and Pricing with Reinforcement Learning

Implement a batch-mode off-policy model-free Q-Learning by Fitted Q-Iteration. The only data available is given by a set of $N_{MC}$ paths for the underlying state variable $X_t$, hedge position $a_t$, instantaneous reward $R_t$ and the next-time value $X_{t+1}$.

\[\mathcal F_t^k=\left\{\left(X_t^k,a_t^k,R_t^k,X_{t+1}^k\right)\right\}_{t=0}^{T-1}\quad k=1,...,N_{MC}\]Detailed steps of solving the Bellman optimalty equation by Reinforcement Learning are illustrated below.

Expand Q-function in basis functions with time-dependent coefficients parametrized by a matrix $\mathbf W_t$.

\[Q_t^\star\left(X_t,a_t\right)=\mathbf A_t^T\mathbf W_t\Phi\left(X_t\right)=\mathbf A_t^T\mathbf U_W\left(t,X_t\right)=\vec{W}_t^T \vec{\Psi}\left(X_t,a_t\right)\] \[\mathbf A_t=\left(\begin{matrix}1\\a_t\\\frac{1}{2}a_t^2\end{matrix}\right)\quad\mathbf U_W\left(t,X_t\right)=\mathbf W_t\Phi\left(X_t\right)\]where $\vec{W}_t$ is obtained by concatenating columns of matrix $\mathbf W_t$ while $ vec \left( {\bf \Psi} \left(X_t,a_t \right) \right) = vec \, \left( {\bf A}_t \otimes {\bf \Phi}^T(X) \right) $ stands for a vector obtained by concatenating columns of the outer product of vectors $ {\bf A}_t $ and $ {\bf \Phi}(X) $.

Compute vector $\mathbf A_t$ then compute $\vec\Psi\left(X_t,a_t\right)$ for each $X_t^k$ and store in a dictionary with key path and time $\left[k,t\right]$.

Part 3: Make off-policy data

- on-policy data - contains an optimal action and the corresponding reward

- off-policy data - contains random action and the corresponding reward

Given a large enough sample, i.e. N_MC tending to infinity Q-Learner will learn an optimal policy from the data in a model-free setting. In our case a random action is an optimal action + noise generated by sampling from uniform: distribution \(a_t\left(X_t\right) = a_t^\star\left(X_t\right) \sim U\left[1-\eta, 1 + \eta\right]\)

where $\eta$ is a disturbance level In other words, each noisy action is calculated by taking optimal action computed previously and multiplying it by a uniform r.v. in the interval $\left[1-\eta, 1 + \eta\right]$

Instructions: In the loop below:

- Compute the optimal policy, and write the result to a_op

- Now disturb these values by a random noise \(a_t\left(X_t\right) = a_t^\star\left(X_t\right) \sim U\left[1-\eta, 1 + \eta\right]\)

- Compute portfolio values corresponding to observed actions \(\Pi_t=\gamma\left[\Pi_{t+1}-a_t^\star\Delta S_t\right]\quad t=T-1,...,0\)

- Compute rewards corrresponding to observed actions \(R_t\left(X_t,a_t,X_{t+1}\right)=\gamma a_t\Delta S_t-\lambda Var\left[\Pi_t\space|\space\mathcal F_t\right]\quad t=T-1,...,0\) with terminal condition \(R_T=-\lambda Var\left[\Pi_T\right]\)

eta = 0.5 # 0.5 # 0.25 # 0.05 # 0.5 # 0.1 # 0.25 # 0.15

reg_param = 1e-3

np.random.seed(42) # Fix random seed

# disturbed optimal actions to be computed

a_op = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

a_op.iloc[:,-1] = 0

# also make portfolios and rewards

# portfolio value

Pi_op = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Pi_op.iloc[:,-1] = S.iloc[:,-1].apply(lambda x: terminal_payoff(x, K))

Pi_op_hat = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Pi_op_hat.iloc[:,-1] = Pi_op.iloc[:,-1] - np.mean(Pi_op.iloc[:,-1])

# reward function

R_op = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

R_op.iloc[:,-1] = - risk_lambda * np.var(Pi_op.iloc[:,-1])

# The backward loop

for t in range(T-1, -1, -1):

### START CODE HERE ### (≈ 11-12 lines of code)

# 1. Compute the optimal policy, and write the result to a_op

a_op.loc[:, t] = a.loc[:, t]

# 2. Now disturb these values by a random noise

a_op.loc[:, t] *= np.random.uniform(1 - eta, 1 + eta, size=a_op.shape[0])

# 3. Compute portfolio values corresponding to observed actions

Pi_op.loc[:,t] = gamma * (Pi_op.loc[:,t+1] - a_op.loc[:,t] * delta_S.loc[:,t])

Pi_hat.loc[:,t] = Pi_op.loc[:,t] - np.mean(Pi_op.loc[:,t])

# 4. Compute rewards corrresponding to observed actions

R_op.loc[:,t] = gamma * a_op.loc[:,t] * delta_S.loc[:,t] - risk_lambda * np.var(Pi_op.loc[:,t])

### END CODE HERE ###

print('done with backward loop!')

done with backward loop!

### GRADED PART (DO NOT EDIT) ###

np.random.seed(42)

idx_row = np.random.randint(low=0, high=R_op.shape[0], size=10)

np.random.seed(42)

idx_col = np.random.randint(low=0, high=R_op.shape[1], size=10)

part_1 = list(R_op.loc[idx_row, idx_col].values.flatten())

try:

part1 = " ".join(map(repr, part_1))

except TypeError:

part1 = repr(part_1)

submissions[all_parts[0]]=part1

grading.submit(COURSERA_EMAIL, COURSERA_TOKEN, assignment_key,all_parts[:1],all_parts,submissions)

R_op.loc[idx_row, idx_col].values.flatten()

### GRADED PART (DO NOT EDIT) ###

Submission successful, please check on the coursera grader page for the status

array([ -4.41648229e-02, -1.11627835e+00, -3.26618627e-01,

-4.41648229e-02, 1.86629772e-01, -3.26618627e-01,

-3.26618627e-01, -4.41648229e-02, -1.91643174e+00,

1.86629772e-01, -4.41648229e-02, -1.15471981e+01,

8.36214406e-03, -4.41648229e-02, -5.19860756e-01,

8.36214406e-03, 8.36214406e-03, -4.41648229e-02,

-5.82629891e-02, -5.19860756e-01, -4.41648229e-02,

-2.93024596e+00, -6.70591047e-01, -4.41648229e-02,

3.38303735e-01, -6.70591047e-01, -6.70591047e-01,

-4.41648229e-02, -1.35776224e-01, 3.38303735e-01,

-4.41648229e-02, 3.89179538e-02, -2.11256164e+00,

-4.41648229e-02, -8.62139383e-01, -2.11256164e+00,

-2.11256164e+00, -4.41648229e-02, 1.03931641e+00,

-8.62139383e-01, -4.41648229e-02, -3.88581528e+00,

-2.78664643e-01, -4.41648229e-02, 1.08026845e+00,

-2.78664643e-01, -2.78664643e-01, -4.41648229e-02,

-1.59815566e-01, 1.08026845e+00, -4.41648229e-02,

1.34127261e+00, -1.32542466e+00, -4.41648229e-02,

-1.75711669e-01, -1.32542466e+00, -1.32542466e+00,

-4.41648229e-02, -6.89031647e-01, -1.75711669e-01,

-4.41648229e-02, 1.36065847e+00, -4.83656917e-03,

-4.41648229e-02, 1.01545031e+00, -4.83656917e-03,

-4.83656917e-03, -4.41648229e-02, 1.06509261e+00,

1.01545031e+00, -4.41648229e-02, -5.48069399e-01,

6.69233272e+00, -4.41648229e-02, 2.48031088e+00,

6.69233272e+00, 6.69233272e+00, -4.41648229e-02,

-4.96873017e-01, 2.48031088e+00, -4.41648229e-02,

1.05762523e+00, -5.25381441e+00, -4.41648229e-02,

-3.93284570e+00, -5.25381441e+00, -5.25381441e+00,

-4.41648229e-02, -1.75980494e-01, -3.93284570e+00,

-4.41648229e-02, -1.12194921e-01, -2.04245741e-02,

-4.41648229e-02, -2.95192215e-01, -2.04245741e-02,

-2.04245741e-02, -4.41648229e-02, -1.70008788e+00,

-2.95192215e-01])

### GRADED PART (DO NOT EDIT) ###

np.random.seed(42)

idx_row = np.random.randint(low=0, high=Pi_op.shape[0], size=10)

np.random.seed(42)

idx_col = np.random.randint(low=0, high=Pi_op.shape[1], size=10)

part_2 = list(Pi_op.loc[idx_row, idx_col].values.flatten())

try:

part2 = " ".join(map(repr, part_2))

except TypeError:

part2 = repr(part_2)

submissions[all_parts[1]]=part2

grading.submit(COURSERA_EMAIL, COURSERA_TOKEN, assignment_key,all_parts[:2],all_parts,submissions)

Pi_op.loc[idx_row, idx_col].values.flatten()

### GRADED PART (DO NOT EDIT) ###

Submission successful, please check on the coursera grader page for the status

array([ 0. , 1.42884104, 0.33751419, 0. ,

1.21733506, 0.33751419, 0.33751419, 0. ,

3.11498207, 1.21733506, 0. , 11.42133749,

-0.10310673, 0. , 11.86648425, -0.10310673,

-0.10310673, 0. , 11.85284966, 11.86648425,

0. , 3.77013248, 0.86748124, 0. ,

3.39527529, 0.86748124, 0.86748124, 0. ,

3.50140426, 3.39527529, 0. , 2.37907167,

2.45349463, 0. , 3.21159555, 2.45349463,

2.45349463, 0. , 2.143548 , 3.21159555,

0. , 4.22816728, 0.36745282, 0. ,

3.10906092, 0.36745282, 0.36745282, 0. ,

3.24065673, 3.10906092, 0. , 1.4213709 ,

2.79987609, 0. , 1.57224362, 2.79987609,

2.79987609, 0. , 2.24072042, 1.57224362,

9.05061694, 4.48960086, 5.90296866, 9.05061694,

3.43400874, 5.90296866, 5.90296866, 9.05061694,

2.3390757 , 3.43400874, 11.39022164, 5.65090831,

5.15180177, 11.39022164, 3.12466356, 5.15180177,

5.15180177, 11.39022164, 3.59323901, 3.12466356,

0. , 3.05819303, 4.15983366, 0. ,

6.95803609, 4.15983366, 4.15983366, 0. ,

7.08659999, 6.95803609, 0. , 0.12024876,

0.03147899, 0. , 0.3970914 , 0.03147899,

0.03147899, 0. , 2.08248553, 0.3970914 ])

Override on-policy data with off-policy data

# Override on-policy data with off-policy data

a = a_op.copy() # distrubed actions

Pi = Pi_op.copy() # disturbed portfolio values

Pi_hat = Pi_op_hat.copy()

R = R_op.copy()

# make matrix A_t of shape (3 x num_MC x num_steps)

num_MC = a.shape[0] # number of simulated paths

num_TS = a.shape[1] # number of time steps

a_1_1 = a.values.reshape((1, num_MC, num_TS))

a_1_2 = 0.5 * a_1_1**2

ones_3d = np.ones((1, num_MC, num_TS))

A_stack = np.vstack((ones_3d, a_1_1, a_1_2))

print(A_stack.shape)

(3, 10000, 7)

data_mat_swap_idx = np.swapaxes(data_mat_t,0,2)

print(data_mat_swap_idx.shape) # (12, 10000, 25)

# expand dimensions of matrices to multiply element-wise

A_2 = np.expand_dims(A_stack, axis=1) # becomes (3,1,10000,25)

data_mat_swap_idx = np.expand_dims(data_mat_swap_idx, axis=0) # becomes (1,12,10000,25)

Psi_mat = np.multiply(A_2, data_mat_swap_idx) # this is a matrix of size 3 x num_basis x num_MC x num_steps

# now concatenate columns along the first dimension

# Psi_mat = Psi_mat.reshape(-1, a.shape[0], a.shape[1], order='F')

Psi_mat = Psi_mat.reshape(-1, N_MC, T+1, order='F')

print(Psi_mat.shape) #

(12, 10000, 7)

(36, 10000, 7)

# make matrix S_t

Psi_1_aux = np.expand_dims(Psi_mat, axis=1)

Psi_2_aux = np.expand_dims(Psi_mat, axis=0)

print(Psi_1_aux.shape, Psi_2_aux.shape)

S_t_mat = np.sum(np.multiply(Psi_1_aux, Psi_2_aux), axis=2)

print(S_t_mat.shape)

(36, 1, 10000, 7) (1, 36, 10000, 7)

(36, 36, 7)

# clean up some space

del Psi_1_aux, Psi_2_aux, data_mat_swap_idx, A_2

Part 4: Calculate $\mathbf S_t$ and $\mathbf M_t$ marix and vector

Vector $\vec W_t$ could be solved by

\[\vec W_t=\mathbf S_t^{-1}\mathbf M_t\]where $\mathbf S_t$ and $\mathbf M_t$ are matrix and vector respectively with elements given by

\[S_{nm}^{\left(t\right)}=\sum_{k=1}^{N_{MC}}{\Psi_n\left(X_t^k,a_t^k\right)\Psi_m\left(X_t^k,a_t^k\right)}\quad\quad M_n^{\left(t\right)}=\sum_{k=1}^{N_{MC}}{\Psi_n\left(X_t^k,a_t^k\right)\left(R_t\left(X_t,a_t,X_{t+1}\right)+\gamma\max_{a_{t+1}\in\mathcal{A}}Q_{t+1}^\star\left(X_{t+1},a_{t+1}\right)\right)}\]Define function function_S and function_M to compute the value of matrix $\mathbf S_t$ and vector $\mathbf M_t$.

Instructions:

- implement function_S_vec() which computes $S_{nm}^{\left(t\right)}$ matrix

- implement function_M_vec() which computes $M_n^{\left(t\right)}$ column vector

# vectorized functions

def function_S_vec(t, S_t_mat, reg_param):

"""

function_S_vec - calculate S_{nm} matrix from Eq. (75) (with a regularization!)

Eq. (75) in QLBS Q-Learner in the Black-Scholes-Merton article

num_Qbasis = 3 x num_basis, 3 because of the basis expansion (1, a_t, 0.5 a_t^2)

Arguments:

t - time index, a scalar, an index into time axis of S_t_mat

S_t_mat - pandas.DataFrame of dimension num_Qbasis x num_Qbasis x T

reg_param - regularization parameter, a scalar

Return:

S_mat_reg - num_Qbasis x num_Qbasis

"""

### START CODE HERE ### (≈ 4-5 lines of code)

# S_mat_reg = your code goes here ...

num_Qbasis = S_t_mat.shape[0]

S_mat_reg = S_t_mat[:,:,t] + reg_param * np.eye(num_Qbasis)

### END CODE HERE ###

return S_mat_reg

def function_M_vec(t,

Q_star,

R,

Psi_mat_t,

gamma=gamma):

"""

function_S_vec - calculate M_{nm} vector from Eq. (75) (with a regularization!)

Eq. (75) in QLBS Q-Learner in the Black-Scholes-Merton article

num_Qbasis = 3 x num_basis, 3 because of the basis expansion (1, a_t, 0.5 a_t^2)

Arguments:

t- time index, a scalar, an index into time axis of S_t_mat

Q_star - pandas.DataFrame of Q-function values of dimension N_MC x T

R - pandas.DataFrame of rewards of dimension N_MC x T

Psi_mat_t - pandas.DataFrame of dimension num_Qbasis x N_MC

gamma - one time-step discount factor $exp(-r \delta t)$

Return:

M_t - np.array of dimension num_Qbasis x 1

"""

### START CODE HERE ### (≈ 2-3 lines of code)

# M_t = your code goes here ...

M_t = np.dot(Psi_mat_t, R.loc[:,t] + gamma * Q_star.loc[:, t+1])

### END CODE HERE ###

return M_t

### GRADED PART (DO NOT EDIT) ###

reg_param = 1e-3

np.random.seed(42)

S_mat_reg = function_S_vec(T-1, S_t_mat, reg_param)

idx_row = np.random.randint(low=0, high=S_mat_reg.shape[0], size=10)

np.random.seed(42)

idx_col = np.random.randint(low=0, high=S_mat_reg.shape[1], size=10)

part_3 = list(S_mat_reg[idx_row, idx_col].flatten())

try:

part3 = " ".join(map(repr, part_3))

except TypeError:

part3 = repr(part_3)

submissions[all_parts[2]]=part3

grading.submit(COURSERA_EMAIL, COURSERA_TOKEN, assignment_key,all_parts[:3],all_parts,submissions)

S_mat_reg[idx_row, idx_col].flatten()

### GRADED PART (DO NOT EDIT) ###

Submission successful, please check on the coursera grader page for the status

array([ 2.22709265e-01, 2.68165972e+02, 4.46911166e+01,

2.00678517e+00, 1.10020457e+03, 8.44758984e-01,

2.29671816e+02, 2.29671816e+02, 3.78571544e-03,

1.41884196e-02])

### GRADED PART (DO NOT EDIT) ###

Q_RL = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Q_RL.iloc[:,-1] = - Pi.iloc[:,-1] - risk_lambda * np.var(Pi.iloc[:,-1])

Q_star = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Q_star.iloc[:,-1] = Q_RL.iloc[:,-1]

M_t = function_M_vec(T-1, Q_star, R, Psi_mat[:,:,T-1], gamma)

part_4 = list(M_t)

try:

part4 = " ".join(map(repr, part_4))

except TypeError:

part4 = repr(part_4)

submissions[all_parts[3]]=part4

grading.submit(COURSERA_EMAIL, COURSERA_TOKEN, assignment_key,all_parts[:4],all_parts,submissions)

M_t

### GRADED PART (DO NOT EDIT) ###

Submission successful, please check on the coursera grader page for the status

array([ -6.03245979e+01, -8.79998437e+01, -2.37497369e+02,

-5.62543448e+02, 2.09052583e+02, -6.44961368e+02,

-2.86243249e+03, 2.77687723e+03, -1.85728309e+03,

-9.40505558e+03, 9.50610806e+03, -5.29328413e+03,

-1.69800964e+04, 1.61026240e+04, -8.42698927e+03,

-8.46211901e+03, 6.05144701e+03, -2.62196067e+03,

-2.12066484e+03, 8.42176836e+02, -2.51624368e+02,

-3.01116012e+02, 2.57124667e+01, -3.22639691e+00,

-5.53769815e+01, 1.67390280e+00, -6.79562288e-02,

-1.61140947e+01, 1.16524075e+00, -1.49934348e-01,

-9.79117274e+00, -7.22309330e-02, -4.70108927e-01,

-6.87393130e+00, -2.10244341e+00, -7.70293521e-01])

Call function_S and function_M for $t=T-1,…,0$ together with vector $\vec\Psi\left(X_t,a_t\right)$ to compute $\vec W_t$ and learn the Q-function $Q_t^\star\left(X_t,a_t\right)=\mathbf A_t^T\mathbf U_W\left(t,X_t\right)$ implied by the input data backward recursively with terminal condition $Q_T^\star\left(X_T,a_T=0\right)=-\Pi_T\left(X_T\right)-\lambda Var\left[\Pi_T\left(X_T\right)\right]$.

When the vector $ \vec{W}_t $ is computed as per the above at time $ t $, we can convert it back to a matrix $ \bf{W}_t $ obtained from the vector $ \vec{W}_t $ by reshaping to the shape $ 3 \times M $.

We can now calculate the matrix $ {\bf U}_t $ at time $ t $ for the whole set of MC paths as follows (this is Eq.(65) from the paper in a matrix form):

\[\mathbf U_{W} \left(t,X_t \right) = \left[\begin{matrix} \mathbf U_W^{0,k}\left(t,X_t \right) \\ \mathbf U_W^{1,k}\left(t,X_t \right) \\ \mathbf U_W^{2,k} \left(t,X_t \right) \end{matrix}\right] = \bf{W}_t \Phi_t \left(t,X_t \right)\]Here the matrix $ {\bf \Phi}t $ has the shape shape $ M \times N{MC}$. Therefore, their dot product has dimension $ 3 \times N_{MC}$, as it should be.

Once this matrix $ {\bf U}t $ is computed, individual vectors $ {\bf U}{W}^{1}, {\bf U}{W}^{2}, {\bf U}{W}^{3} $ for all MC paths are read off as rows of this matrix.

From here, we can compute the optimal action and optimal Q-function $Q^{\star}(X_t, a_t^{\star}) $ at the optimal action for a given step $ t $. This will be used to evaluate the $ \max_{a_{t+1} \in \mathcal{A}} Q^{\star} \left(X_{t+1}, a_{t+1} \right) $.

The optimal action and optimal Q-function with the optimal action could be computed by

\[a_t^\star\left(X_t\right)=\frac{\mathbb{E}_{t} \left[ \Delta \hat{S}_{t} \hat{\Pi}_{t+1} + \frac{1}{2 \gamma \lambda} \Delta S_{t} \right]}{ \mathbb{E}_{t} \left[ \left( \Delta \hat{S}_{t} \right)^2 \right]}\, , \quad\quad Q_t^\star\left(X_t,a_t^\star\right)=\mathbf U_W^{\left(0\right)}\left(t,X_t\right)+ a_t^\star \mathbf U_W^{\left(2\right)}\left(t,X_t\right) +\frac{1}{2}\left(a_t^\star\right)^2\mathbf U_W^{\left(2\right)}\left(t,X_t\right)\]with terminal condition $a_T^\star=0$ and $Q_T^\star\left(X_T,a_T^\star=0\right)=-\Pi_T\left(X_T\right)-\lambda Var\left[\Pi_T\left(X_T\right)\right]$.

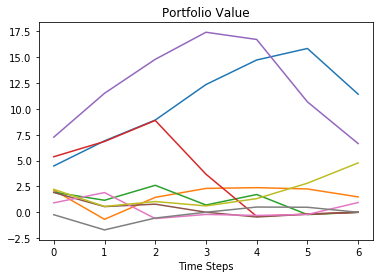

Plots of 5 optimal action $a_t^\star\left(X_t\right)$, optimal Q-function with optimal action $Q_t^\star\left(X_t,a_t^\star\right)$ and implied Q-function $Q_t^\star\left(X_t,a_t\right)$ paths are shown below.

Fitted Q Iteration (FQI)

starttime = time.time()

# implied Q-function by input data (using the first form in Eq.(68))

Q_RL = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Q_RL.iloc[:,-1] = - Pi.iloc[:,-1] - risk_lambda * np.var(Pi.iloc[:,-1])

# optimal action

a_opt = np.zeros((N_MC,T+1))

a_star = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

a_star.iloc[:,-1] = 0

# optimal Q-function with optimal action

Q_star = pd.DataFrame([], index=range(1, N_MC+1), columns=range(T+1))

Q_star.iloc[:,-1] = Q_RL.iloc[:,-1]

# max_Q_star_next = Q_star.iloc[:,-1].values

max_Q_star = np.zeros((N_MC,T+1))

max_Q_star[:,-1] = Q_RL.iloc[:,-1].values

num_basis = data_mat_t.shape[2]

reg_param = 1e-3

hyper_param = 1e-1

# The backward loop

for t in range(T-1, -1, -1):

# calculate vector W_t

S_mat_reg = function_S_vec(t,S_t_mat,reg_param)

M_t = function_M_vec(t,Q_star, R, Psi_mat[:,:,t], gamma)

W_t = np.dot(np.linalg.inv(S_mat_reg),M_t) # this is an 1D array of dimension 3M

# reshape to a matrix W_mat

W_mat = W_t.reshape((3, num_basis), order='F') # shape 3 x M

# make matrix Phi_mat

Phi_mat = data_mat_t[t,:,:].T # dimension M x N_MC

# compute matrix U_mat of dimension N_MC x 3

U_mat = np.dot(W_mat, Phi_mat)

# compute vectors U_W^0,U_W^1,U_W^2 as rows of matrix U_mat

U_W_0 = U_mat[0,:]

U_W_1 = U_mat[1,:]

U_W_2 = U_mat[2,:]

# IMPORTANT!!! Instead, use hedges computed as in DP approach:

# in this way, errors of function approximation do not back-propagate.

# This provides a stable solution, unlike

# the first method that leads to a diverging solution

A_mat = function_A_vec(t, delta_S_hat, data_mat_t, reg_param)

B_vec = function_B_vec(t, Pi_hat, delta_S_hat, S, data_mat_t)

# print ('t = A_mat.shape = B_vec.shape = ', t, A_mat.shape, B_vec.shape)

phi = np.dot(np.linalg.inv(A_mat), B_vec)

a_opt[:,t] = np.dot(data_mat_t[t,:,:],phi)

a_star.loc[:,t] = a_opt[:,t]

max_Q_star[:,t] = U_W_0 + a_opt[:,t] * U_W_1 + 0.5 * (a_opt[:,t]**2) * U_W_2

# update dataframes

Q_star.loc[:,t] = max_Q_star[:,t]

# update the Q_RL solution given by a dot product of two matrices W_t Psi_t

Psi_t = Psi_mat[:,:,t].T # dimension N_MC x 3M

Q_RL.loc[:,t] = np.dot(Psi_t, W_t)

# trim outliers for Q_RL

up_percentile_Q_RL = 95 # 95

low_percentile_Q_RL = 5 # 5

low_perc_Q_RL, up_perc_Q_RL = np.percentile(Q_RL.loc[:,t],[low_percentile_Q_RL,up_percentile_Q_RL])

# print('t = %s low_perc_Q_RL = %s up_perc_Q_RL = %s' % (t, low_perc_Q_RL, up_perc_Q_RL))

# trim outliers in values of max_Q_star:

flag_lower = Q_RL.loc[:,t].values < low_perc_Q_RL

flag_upper = Q_RL.loc[:,t].values > up_perc_Q_RL

Q_RL.loc[flag_lower,t] = low_perc_Q_RL

Q_RL.loc[flag_upper,t] = up_perc_Q_RL

endtime = time.time()

print('\nTime Cost:', endtime - starttime, 'seconds')

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:21: FutureWarning: reshape is deprecated and will raise in a subsequent release. Please use .values.reshape(...) instead

/opt/conda/lib/python3.6/site-packages/numpy/lib/function_base.py:4116: RuntimeWarning: Invalid value encountered in percentile

interpolation=interpolation)

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:77: RuntimeWarning: invalid value encountered in less

/opt/conda/lib/python3.6/site-packages/ipykernel_launcher.py:78: RuntimeWarning: invalid value encountered in greater

Time Cost: 4.891070604324341 seconds

# plot both simulations

f, axarr = plt.subplots(3, 1)

f.subplots_adjust(hspace=.5)

f.set_figheight(8.0)

f.set_figwidth(8.0)

step_size = N_MC // 10

idx_plot = np.arange(step_size, N_MC, step_size)

axarr[0].plot(a_star.T.iloc[:, idx_plot])

axarr[0].set_xlabel('Time Steps')

axarr[0].set_title(r'Optimal action $a_t^{\star}$')

axarr[1].plot(Q_RL.T.iloc[:, idx_plot])

axarr[1].set_xlabel('Time Steps')

axarr[1].set_title(r'Q-function $Q_t^{\star} (X_t, a_t)$')

axarr[2].plot(Q_star.T.iloc[:, idx_plot])

axarr[2].set_xlabel('Time Steps')

axarr[2].set_title(r'Optimal Q-function $Q_t^{\star} (X_t, a_t^{\star})$')

plt.savefig('QLBS_FQI_off_policy_summary_ATM_eta_%d.png' % (100 * eta), dpi=600)

plt.show()

Compare the optimal action $a_t^\star\left(X_t\right)$ and optimal Q-function with optimal action $Q_t^\star\left(X_t,a_t^\star\right)$ given by Dynamic Programming and Reinforcement Learning.

Plots of 1 path comparisons are given below.

# plot a and a_star

# plot 1 path

num_path = 120 # 240 # 260 # 300 # 430 # 510

# Note that a from the DP method and a_star from the RL method are now identical by construction

plt.plot(a.T.iloc[:,num_path], label="DP Action")

plt.plot(a_star.T.iloc[:,num_path], label="RL Action")

plt.legend()

plt.xlabel('Time Steps')

plt.title('Optimal Action Comparison Between DP and RL')

plt.show()

Summary of the RL-based pricing with QLBS

# QLBS option price

C_QLBS = - Q_star.copy() # Q_RL #

print('---------------------------------')

print(' QLBS RL Option Pricing ')

print('---------------------------------\n')

print('%-25s' % ('Initial Stock Price:'), S0)

print('%-25s' % ('Drift of Stock:'), mu)

print('%-25s' % ('Volatility of Stock:'), sigma)

print('%-25s' % ('Risk-free Rate:'), r)

print('%-25s' % ('Risk aversion parameter :'), risk_lambda)

print('%-25s' % ('Strike:'), K)

print('%-25s' % ('Maturity:'), M)

print('%-26s %.4f' % ('\nThe QLBS Put Price 1 :', (np.mean(C_QLBS.iloc[:,0]))))

print('%-26s %.4f' % ('\nBlack-Sholes Put Price:', bs_put(0)))

print('\n')

# # plot one path

# plt.plot(C_QLBS.T.iloc[:,[200]])

# plt.xlabel('Time Steps')

# plt.title('QLBS RL Option Price')

# plt.show()

---------------------------------

QLBS RL Option Pricing

---------------------------------

Initial Stock Price: 100

Drift of Stock: 0.05

Volatility of Stock: 0.15

Risk-free Rate: 0.03

Risk aversion parameter : 0.001

Strike: 100

Maturity: 1

The QLBS Put Price 1 : nan

Black-Sholes Put Price: 4.5296

### GRADED PART (DO NOT EDIT) ###

part5 = str(C_QLBS.iloc[0,0])

submissions[all_parts[4]]=part5

grading.submit(COURSERA_EMAIL, COURSERA_TOKEN, assignment_key,all_parts[:5],all_parts,submissions)

C_QLBS.iloc[0,0]

### GRADED PART (DO NOT EDIT) ###

Submission successful, please check on the coursera grader page for the status

nan

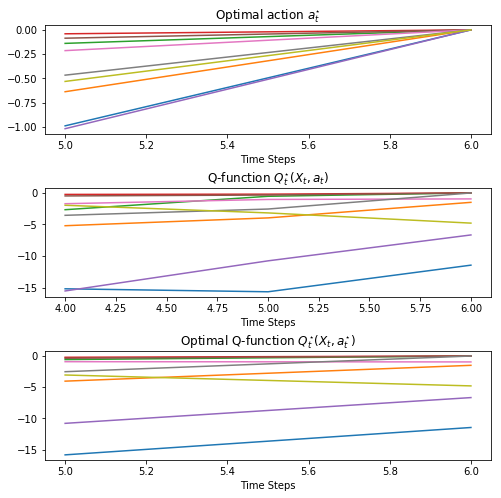

# add here calculation of different MC runs (6 repetitions of action randomization)

# on-policy values

y1_onp = 5.0211 # 4.9170

y2_onp = 4.7798 # 7.6500

# QLBS_price_on_policy = 4.9004 +/- 0.1206

# these are the results for noise eta = 0.15

# p1 = np.array([5.0174, 4.9249, 4.9191, 4.9039, 4.9705, 4.6216 ])

# p2 = np.array([6.3254, 8.6733, 8.0686, 7.5355, 7.1751, 7.1959 ])

p1 = np.array([5.0485, 5.0382, 5.0211, 5.0532, 5.0184])

p2 = np.array([4.7778, 4.7853, 4.7781,4.7805, 4.7828])

# results for eta = 0.25

# p3 = np.array([4.9339, 4.9243, 4.9224, 5.1643, 5.0449, 4.9176 ])

# p4 = np.array([7.7696,8.1922, 7.5440,7.2285, 5.6306, 12.6072])

p3 = np.array([5.0147, 5.0445, 5.1047, 5.0644, 5.0524])

p4 = np.array([4.7842,4.7873, 4.7847, 4.7792, 4.7796])

# eta = 0.35

# p7 = np.array([4.9718, 4.9528, 5.0170, 4.7138, 4.9212, 4.6058])

# p8 = np.array([8.2860, 7.4012, 7.2492, 8.9926, 6.2443, 6.7755])

p7 = np.array([5.1342, 5.2288, 5.0905, 5.0784, 5.0013 ])

p8 = np.array([4.7762, 4.7813,4.7789, 4.7811, 4.7801])

# results for eta = 0.5

# p5 = np.array([4.9446, 4.9894,6.7388, 4.7938,6.1590, 4.5935 ])

# p6 = np.array([7.5632, 7.9250, 6.3491, 7.3830, 13.7668, 14.6367 ])

p5 = np.array([3.1459, 4.9673, 4.9348, 5.2998, 5.0636 ])

p6 = np.array([4.7816, 4.7814, 4.7834, 4.7735, 4.7768])

# print(np.mean(p1), np.mean(p3), np.mean(p5))

# print(np.mean(p2), np.mean(p4), np.mean(p6))

# print(np.std(p1), np.std(p3), np.std(p5))

# print(np.std(p2), np.std(p4), np.std(p6))

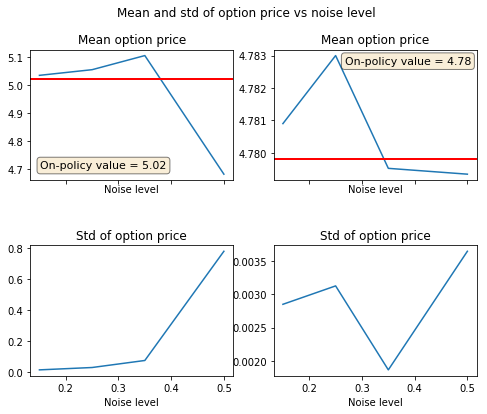

x = np.array([0.15, 0.25, 0.35, 0.5])

y1 = np.array([np.mean(p1), np.mean(p3), np.mean(p7), np.mean(p5)])

y2 = np.array([np.mean(p2), np.mean(p4), np.mean(p8), np.mean(p6)])

y_err_1 = np.array([np.std(p1), np.std(p3),np.std(p7), np.std(p5)])

y_err_2 = np.array([np.std(p2), np.std(p4), np.std(p8), np.std(p6)])

# plot it

f, axs = plt.subplots(nrows=2, ncols=2, sharex=True)

f.subplots_adjust(hspace=.5)

f.set_figheight(6.0)

f.set_figwidth(8.0)

ax = axs[0,0]

ax.plot(x, y1)

ax.axhline(y=y1_onp,linewidth=2, color='r')

textstr = 'On-policy value = %2.2f'% (y1_onp)

props = dict(boxstyle='round', facecolor='wheat', alpha=0.5)

# place a text box in upper left in axes coords

ax.text(0.05, 0.15, textstr, fontsize=11,transform=ax.transAxes, verticalalignment='top', bbox=props)

ax.set_title('Mean option price')

ax.set_xlabel('Noise level')

ax = axs[0,1]

ax.plot(x, y2)

ax.axhline(y=y2_onp,linewidth=2, color='r')

textstr = 'On-policy value = %2.2f'% (y2_onp)

props = dict(boxstyle='round', facecolor='wheat', alpha=0.5)

# place a text box in upper left in axes coords

ax.text(0.35, 0.95, textstr, fontsize=11,transform=ax.transAxes, verticalalignment='top', bbox=props)

ax.set_title('Mean option price')

ax.set_xlabel('Noise level')

ax = axs[1,0]

ax.plot(x, y_err_1)

ax.set_title('Std of option price')

ax.set_xlabel('Noise level')

ax = axs[1,1]

ax.plot(x, y_err_2)

ax.set_title('Std of option price')

ax.set_xlabel('Noise level')

f.suptitle('Mean and std of option price vs noise level')

plt.savefig('Option_price_vs_noise_level.png', dpi=600)

plt.show()